Get Sba 1150 1977-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SBA 1150 online

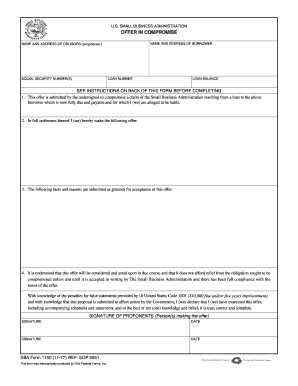

Filling out the SBA 1150 form online can be a straightforward process when approached with the right guidance. This form is essential for making a compromise offer regarding a Small Business Administration loan, and proper completion is critical for your submission to be considered.

Follow the steps to successfully complete your SBA 1150 form.

- Press the ‘Get Form’ button to access the SBA 1150 form and open it in your preferred online document editor.

- Begin by filling out the name and address of the borrower at the top of the form. Ensure that all information is accurate as it is critical for processing.

- Provide the name and address of any obligors involved in the loan. This section requires accurate contact details to ensure all parties are notified.

- Enter the social security number(s) associated with the borrower and obligors. Double-check for accuracy to avoid complications.

- Fill in the loan number. This should be readily available in your loan documents.

- Indicate the loan balance. It is essential to state the correct amount due to ensure the offer is processed accurately.

- In section two, clearly and concisely state your offer for compromise. Include the dollar amount you are proposing to settle the claim, along with any expected concessions.

- Provide your rationale in section three. Detail the facts and reasons to justify why the SBA should accept your compromise offer.

- Sign and date the form at the end, ensuring all proponents have signed if applicable. This confirms your agreement with the information presented and its accuracy.

- Once completed, review the entire form for any errors or omissions. You may save changes, download the completed form, print it, or share it through your online document management system.

Take the next step toward submitting your SBA compromise offer by completing the SBA 1150 form online today.

SBA loans can qualify for forgiveness under specific conditions, particularly if they support eligible expenses. Recent guidelines indicate that borrowers may seek forgiveness by demonstrating proper use of funds. However, it's essential to refer to the SBA 1150 and other relevant documents to ensure compliance. For detailed assistance, US Legal Forms can guide you through the forgiveness process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.