Loading

Get Til 2011 B 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TIL 2011 B online

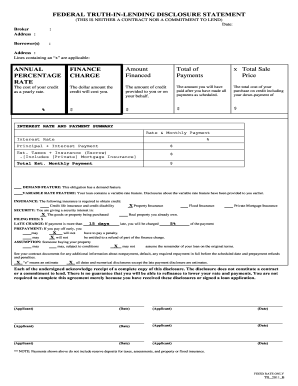

This guide will assist you in filling out the TIL 2011 B form efficiently and accurately. It is designed for users with varying levels of familiarity with legal documents, ensuring that everyone can complete the process smoothly.

Follow the steps to complete your TIL 2011 B form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the date of the form in the specified field. This indicates when the document was completed.

- Fill in the broker's name and address, ensuring that all information is accurate and up to date.

- Input the borrower's name(s) and address. This is important for identifying the parties involved in the transaction.

- Review the fields marked with an 'x'. These are applicable sections for your situation. For example, enter the annual percentage rate, finance charge, amount financed, and total of payments.

- Complete the interest rate and payment summary. Enter the interest rate, principal plus interest payment, estimated taxes, and any insurance amounts.

- Review and check sections regarding demand features, variable rate features, insurance requirements, and security interest. Make sure you understand what applies to your loan.

- Complete any additional disclosures such as prepayment penalties and assumptions regarding loan terms if applicable.

- Make sure to acknowledge the receipt of the disclosure by signing and dating the form where indicated.

- Once you have completed the form, you can save your changes, download, print, or share the finalized document.

Start filling out your TIL 2011 B form online today!

The oldest tax return you can file is generally for the 2011 tax year, considering that you are addressing the statutes outlined in TIL 2011 B. The IRS allows taxpayers to file back taxes, but the ability to claim a refund is limited to the past three years. Remember to comply with all relevant guidelines to avoid issues. US Legal Forms can support you in preparing and filing your tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.