Loading

Get Sc Application For Homestead Exemption

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC Application for Homestead Exemption online

Completing the SC Application for Homestead Exemption online can be a straightforward process with the right guidance. This guide provides clear instructions to help you fill out each section of the application accurately and efficiently.

Follow the steps to successfully complete your application online.

- Click ‘Get Form’ button to access the application form and open it in your preferred digital editor.

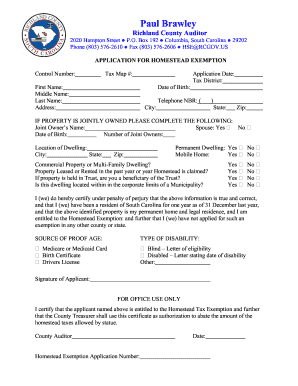

- Begin by entering the control number and tax map number at the top of the form. This information helps identify your property.

- Fill in your personal details: first name, middle name, last name, and address. Provide the application date, tax district, date of birth, and telephone number.

- If your property is jointly owned, complete the additional fields with the joint owner's name, their date of birth, and indicate the number of joint owners.

- Specify the location of the dwelling, including city, state, and zip code. Confirm whether your dwelling is a permanent residence and whether it is a mobile home.

- Answer questions regarding the property’s use; indicate if it is a commercial property or a multi-family dwelling and if it has been rented or leased in the past year.

- If applicable, specify whether the property is held in trust and if you are a beneficiary of that trust. Indicate if the dwelling is within the corporate limits of a municipality.

- Certify your information by signing the application, confirming you are a resident of South Carolina and entitled to the exemption. Provide your source of proof for age or disability as applicable.

- Review all entered information for accuracy before completing the process. Once satisfied, save changes, download, print, or share the completed form as needed.

Start your application process today and complete the SC Application for Homestead Exemption online.

To file for the SC Application for Homestead Exemption, you must complete the application form available through your county's assessor's office. Ensure you gather all necessary documents that prove eligibility before submission. Following these steps helps ensure a smooth application process, maximizing your potential savings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.