Loading

Get Cash Deposit Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cash Deposit Form online

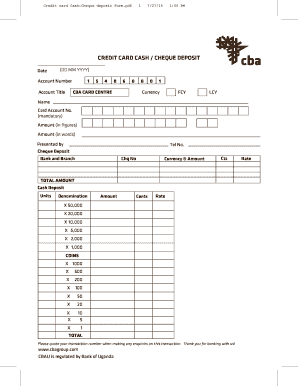

Filling out the Cash Deposit Form online is a straightforward process that allows you to deposit cash or cheque efficiently. This guide provides detailed steps to help you complete the form correctly and ensure your deposit is processed without issues.

Follow the steps to complete the Cash Deposit Form online

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering the date of the deposit in the designated field, using the format DD MM YYYY.

- Fill in your account number in the provided section to ensure the funds are credited to the correct account.

- Enter the account title, ensuring this matches the name associated with the account holder.

- Specify the currency of your deposit by choosing between foreign currency (FCY) or local currency (LCY).

- Input the amount of the deposit in figures in the designated field, followed by writing the amount in words to avoid any discrepancies.

- If you are presenting a cheque for deposit, fill in the cheque number and the bank and branch from which the cheque is drawn.

- For cash deposits, list the denominations and quantities of each denomination in the corresponding sections, ensuring accuracy.

- Review the total amount of cash and cheque deposits calculated at the bottom of the form for correctness.

- When all fields are completed, save your changes or download the form for printing, sharing, or submitting.

Complete your Cash Deposit Form online today for a hassle-free deposit experience.

By law, individuals, businesses and trades must file Form 8300 to the IRS within 15 days of receiving a cash sum of $10,000 or more. This form is meant to help prevent money laundering. Everyone involved in the transaction will also need to provide a written statement to be filed along with Form 8300.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.