Loading

Get Streamlined Sales And Use Tax Agreement Certificate Bb - Certcapture

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Streamlined Sales And Use Tax Agreement Certificate Bb - CertCapture online

Filling out the Streamlined Sales And Use Tax Agreement Certificate Bb - CertCapture online is an essential process for ensuring proper tax exemption. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the form successfully.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

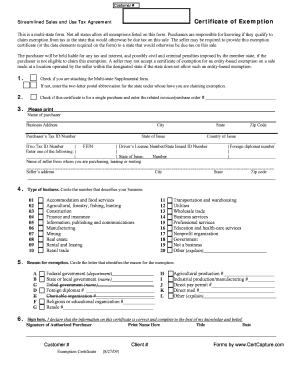

- Check if you are attaching the Multi-state Supplemental form. If not, enter the two-letter postal abbreviation for the state under whose laws you are claiming exemption.

- Indicate if this certificate is for a single purchase by checking the appropriate box and entering the related invoice or purchase order number.

- Provide the name of the purchaser, business address, city, state, and zip code accurately.

- Enter the Purchaser’s Tax ID Number and the state and country of issuance. If you do not have a Tax ID Number, specify an alternative identification number.

- Provide the name and address of the seller from whom you are purchasing, leasing, or renting.

- Circle the number that best describes your type of business from the provided options.

- Circle the letter that identifies the reason for the exemption from the list provided to ensure you are claiming the correct reason.

- If applicable, enter specific identification numbers related to any government or charitable organization exemption.

- Sign the certificate, ensuring that the signature is from an authorized purchaser. Print the name, title, and date to complete this form.

- Once all sections are accurately filled out, save your changes, and you may choose to download, print, or share the completed form as needed.

Start filling out your documents online today for a smoother tax exemption process.

What is SST? SST stands for Streamlined Sales Tax. The purpose of the SST Agreement is to simplify and modernize sales and use tax administration in member states in order to substantially reduce the burden of tax compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.