Loading

Get Ar Et185a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ar Et185a online

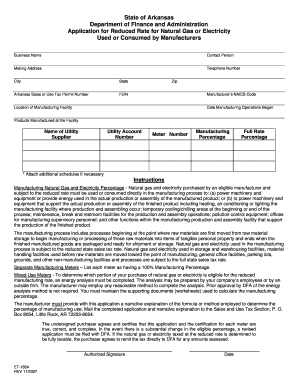

The Ar Et185a is an essential application for manufacturers seeking a reduced rate for natural gas or electricity used in their operations. This guide will help you navigate the online form with clarity and ease.

Follow the steps to complete the Ar Et185a online successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide the business name in the designated field to identify your manufacturing operation.

- Fill in the contact person's name, ensuring clear communication lines for any follow-up.

- Enter the mailing address, including the city, state, and zip code, to ensure proper documentation delivery.

- List the telephone number for primary contact regarding the application.

- Input your Arkansas sales or use tax permit number, as this is crucial for tax identification.

- Provide your Federal Employer Identification Number (FEIN) for verification purposes.

- Indicate your manufacturer’s NAICS code to categorize your business appropriately.

- Enter the location of your manufacturing facility to establish where the operations are conducted.

- Specify the date when manufacturing operations began to reflect the operational timeline.

- List the products manufactured at the facility to clarify what items benefit from the reduced rate.

- Include the name of your utility supplier and the associated utility account number for reference.

- Provide the meter number for tracking the energy usage accurately.

- Calculate and input the manufacturing percentage reflecting the ratio of eligible to total energy use.

- Enter the full rate percentage applicable to your operation as required.

- Attach any additional schedules if necessary to support your application.

- Review all entries for accuracy before finalizing the form.

- Save changes, then download or print the completed application for submission.

- Submit the application and any necessary documentation to the Sales and Use Tax Section.

Complete your Ar Et185a form online today for efficient processing.

Some customers are exempt from paying sales tax under Arkansas law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.