Loading

Get Au Nat 13471 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AU NAT 13471 online

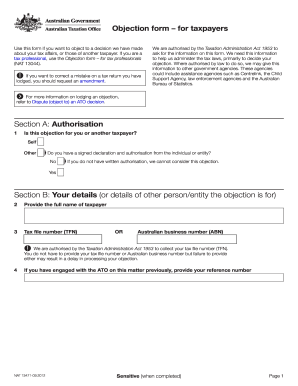

Filling out the AU NAT 13471 form online is a crucial step for users who wish to object to a tax decision. This guide will provide you with supportive and clear instructions to navigate the process effectively.

Follow the steps to complete your AU NAT 13471 online.

- Click ‘Get Form’ button to access the AU NAT 13471 form and open it in your preferred editing tool.

- In Section A, indicate whether the objection is for yourself or for another taxpayer. If it is for another taxpayer, ensure you have a signed declaration and authorization.

- In Section B, provide the full name of the taxpayer or other person/entity, along with their tax file number (TFN) or Australian business number (ABN). Note that providing these numbers is optional but may slow the process if omitted.

- If you have engaged with the Australian Taxation Office (ATO) regarding this issue previously, include any reference number associated with that engagement in Section B.

- In Section C, identify the contact person for the objection and provide their contact details including phone number, fax number (if applicable), mobile number, and email address.

- Next, enter the address for correspondence related to the objection in Section C, including the suburb, state/territory, and postcode.

- Moving to Section D, describe the topic of your objection and detail the decision you are objecting to. Include key information such as the type of decision, date, and relevant reference numbers.

- Confirm whether your objection is within the time limit set for lodging such requests. If it is not, decide if you would like it treated as if lodged in time, and provide explanations as necessary.

- Clearly articulate your reasons for the objection in Section D, providing facts and arguments that support your case.

- In Section D, also note any supporting evidence and attach relevant documents, like receipts or invoices, which may help substantiate your objection.

- Complete Section E by signing and dating the form. If lodging on behalf of another taxpayer, ensure you have their authority to do so.

- Finally, you can save your changes, download the form, print it, or share it as needed once all sections are completed.

Complete your AU NAT 13471 form online today to ensure your objection is properly lodged.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To communicate with the ATO, you can use several options including phone calls, online chat, or via the post. When contacting them, having AU NAT 13471 on hand may help clarify your situation. Choose the method that you feel most comfortable with and aligns with your needs.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.