Loading

Get Irs 9611 1997-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 9611 online

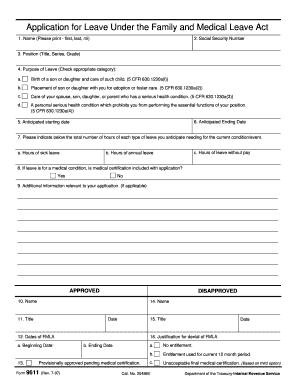

The IRS 9611 form is essential for employees seeking leave under the Family and Medical Leave Act. This guide will provide you with clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to fill out the IRS 9611 online effectively.

- Press the ‘Get Form’ button to access the IRS 9611 form and open it in the designated editor.

- Enter your name, making sure to print it clearly with your first name, last name, and middle initial.

- Provide your Social Security Number, ensuring accuracy to avoid delays.

- Fill in your position title, series, and grade to identify your employment details.

- Check the appropriate category for the purpose of your leave, choosing from options such as birth, adoption, care of a family member, or your serious health condition.

- Indicate your anticipated starting date for the leave.

- Specify the anticipated ending date for the leave.

- Below the dates, enter the total number of hours you anticipate needing for each type of leave: sick leave, annual leave, and leave without pay.

- If your leave is due to a medical condition, indicate whether medical certification is included by selecting 'Yes' or 'No'.

- Provide any additional information relevant to your application in the space provided.

- If your application is being reviewed or has been approved or disapproved, complete the necessary fields including names, titles, dates, and any justification for denial if applicable.

- Finally, review all the information for accuracy, save your changes, and proceed to download, print, or share the form as needed.

Complete your IRS 9611 form online now to ensure a smooth application process.

The easiest way to file your own taxes is to use an online tax software that guides you through each step. Many platforms offer user-friendly interfaces and ensure compliance with IRS 9611 regulations. This method often simplifies the experience, allowing you to complete your taxes efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.