Loading

Get Otc 974

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Otc 974 online

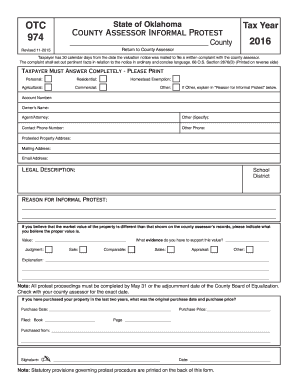

The Otc 974 form is an essential document for taxpayers in Oklahoma wishing to file an informal protest regarding property valuation. This guide provides clear, step-by-step instructions to help users navigate the process of completing the form online.

Follow the steps to fill out the Otc 974 accurately and efficiently.

- Press the ‘Get Form’ button to access the Otc 974 form and open it in your preferred online editor.

- Begin by providing your personal information in the 'Personal' section. This includes your account number, owner’s name, agent or attorney details, and contact information such as phone numbers and email address.

- In the 'Protested Property Address' field, enter the complete address of the property you are disputing. Additionally, fill out the 'Legal Description' section as accurately as possible.

- State your reason for the informal protest in the 'Reason for Informal Protest' field. Concisely explain why you believe the property’s assessed value is incorrect.

- Indicate your belief of the proper value of the property in the designated 'Value' field. You may also provide evidence supporting your valuation in the available fields for judgment, sales, appraisal, or other forms.

- If applicable, provide details about your property's purchase date and price in the appropriate sections. This information pertains to any purchases made within the last two years.

- Sign and date the form in the designated areas to confirm your protest. Ensure that your signature matches your name as specified at the top of the form.

- Once you have reviewed all entered information for accuracy, you can save your changes, download, or print the form for submission.

Complete your Otc 974 form online today to ensure your protest is filed on time.

Senior citizens (65 and Older) earning $85,300 or less are eligible for the Senior Valuation Freeze which can reduce your property tax bill over time. This will freeze the taxable, or assessed value, of your residential property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.