Loading

Get Ca Charities Form Ct-1 2007-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Charities Form CT-1 online

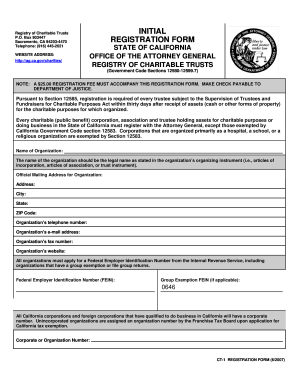

Completing the CA Charities Form CT-1 is an essential step for every charitable organization operating in California. This guide will provide you with clear, step-by-step instructions to help you efficiently fill out the form online.

Follow the steps to successfully complete the CA Charities Form CT-1.

- Click ‘Get Form’ button to obtain the form and access it for editing.

- In the 'Name of Organization' field, enter the full legal name of your organization as it appears in your organizing documents.

- Provide the official mailing address for your organization, including the address, city, state, and ZIP code.

- Fill in the organization's telephone number, email address, fax number, and website address in the respective fields.

- Enter the Federal Employer Identification Number (FEIN) issued by the Internal Revenue Service. If applicable, provide the group exemption FEIN.

- For corporations, include the corporate or organization number assigned in California.

- List the names, positions, and addresses of all trustees, directors, and officers. If necessary, attach an additional sheet.

- Describe the primary activity of your organization. Include information on assets held in California, if applicable.

- Indicate the date when your organization first received assets. Registration is required within thirty days of asset receipt.

- Select the annual accounting period adopted by your organization, either 'Fiscal Year Ending' or 'Calendar Year.'

- Attach the required founding documents based on your organization type: articles of incorporation, bylaws, or trust instrument.

- Indicate whether your organization has applied for or been granted IRS tax-exempt status and provide relevant dates.

- If applicable, detail the name, address, and phone numbers of any commercial fundraiser or fundraising counsel your organization engages.

- Finally, declare the truthfulness of your submission by signing, adding your title, and dating the form.

- Review your filled-out form and then save changes, download it, print, or share as needed.

Complete your CA Charities Form CT-1 online today to ensure compliance with California regulations.

You should file the CA Charities Form CT-1 annually, typically on or before the 15th day of the 5th month after your organization’s fiscal year ends. Missing the deadline may result in penalties or loss of exemption status. Plan ahead to gather necessary financial information and ensure timely submission. Using a reliable platform like uslegalforms can help keep track of your filing deadlines.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.