Loading

Get Trust Drafting Memo Trusteed Ira.pdf - The Private Trust Company

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Trust Drafting Memo Trusteed IRA.pdf - The Private Trust Company online

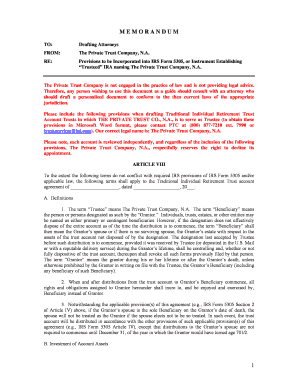

Filling out the Trust Drafting Memo Trusteed IRA.pdf - The Private Trust Company can seem complex, but with clear guidance, it becomes manageable. This document is designed to help you understand and complete the form effectively, ensuring that all necessary provisions are included.

Follow the steps to fill out the form accurately and efficiently.

- Click the ‘Get Form’ button to obtain the Trust Drafting Memo Trusteed IRA PDF and open it in your preferred document editor.

- Begin by filling in the header section, which includes the names of the involved parties: the Grantor and the Trustee. Ensure that the correct legal name is used for The Private Trust Company, N.A.

- In Article VIII, enter the specifics of the traditional Individual Retirement Trust account agreement, like the Grantor's name and the date of the agreement.

- Define the terms used in the document, such as ‘Trustee,’ ‘Beneficiary,’ and ‘Grantor,’ ensuring that each term aligns with the definitions provided in the document.

- Outline the investment instructions, including any specific directions regarding the types of investments allowed and any limitations on investment choices.

- Complete the beneficiary designations, making sure to indicate the primary and contingent beneficiaries clearly, and provide any necessary social security numbers or dates of birth.

- Review the provisions regarding contributions and distributions, ensuring that all details are accurate to avoid any future tax implications.

- Sign and date the document where indicated, and if the Grantor is married, include spousal consent where required.

- After completing all fields, save changes to the document. Depending on your needs, you can download, print, or share the finalized form.

Take the next step and complete your Trust Drafting Memo Trusteed IRA PDF online today!

What is a private trust company? A PTC is an entity whose sole purpose is to act as trustee in relation to a specific trust or trusts. Such entities do not provide trust services generally, and it will be a condition that they must not solicit business from the public at large.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.