Loading

Get State Of New York Antiarson Application (nyfa1) Part 1 Warning: This Application Must Be Completed

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the STATE OF NEW YORK ANTIARSON APPLICATION (NYFA1) PART 1 online

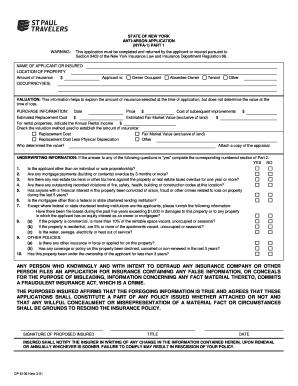

Completing the STATE OF NEW YORK ANTIARSON APPLICATION (NYFA1) PART 1 is essential for those seeking to insure their properties against fire-related risks. This guide will provide you with clear, step-by-step instructions to help you fill out the form correctly and efficiently.

Follow the steps to complete the application form successfully.

- Press the ‘Get Form’ button to access the application form and open it in your preferred online editor.

- Enter the name of the applicant or insured in the designated field.

- Provide the location of the property you are applying to insure.

- Indicate the amount of insurance you are requesting in the specified section.

- Select the occupancy type from the options provided: Owner Occupant, Absentee Owner, Tenant, or Other.

- Fill in the valuation information, including date of purchase, price, cost of subsequent improvements, estimated replacement cost, and estimated fair market value, specifically excluding the land.

- For rental properties, include the annual rental income, if applicable.

- Check one of the valuation methods used to determine insurance amount: Replacement Cost, Fair Market Value, Replacement Cost Less Physical Depreciation, or Other.

- Specify who determined the value of the property by providing the relevant individual or entity's details.

- Review and answer the underwriting questions. If any answers are 'yes,' prepare to complete the corresponding numbered section in Part 2 of the application.

- Acknowledge any relevant policies under 'Other Policies' by answering the related questions.

- Sign and date the application, confirming the accuracy of the information provided.

- Once the form is completed, you can save changes, download, print, or share the form as needed.

Start filling out your application online today to ensure your property is protected.

Related links form

An arson clause is a rule in an insurance policy that says if someone intentionally sets a fire, the insurance company won't pay for any damage caused by that fire. So, if someone burns down their own house on purpose, they can't get money from their insurance company to fix it.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.