Loading

Get Net Pay Worksheet Answers

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Net Pay Worksheet Answers online

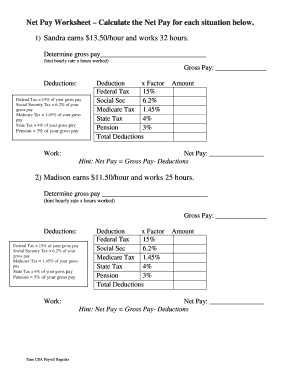

The Net Pay Worksheet Answers is an essential tool for calculating an individual's net pay based on their gross income and applicable deductions. This guide will provide you with clear instructions on how to complete the worksheet efficiently online.

Follow the steps to accurately complete your Net Pay Worksheet Answers

- Press the ‘Get Form’ button to access the Net Pay Worksheet Answers and open it in your preferred editor.

- Begin by calculating the gross pay by multiplying the hourly wage by the total number of hours worked. Enter this amount in the Gross Pay section.

- Next, calculate the deductions. Each deduction is a percentage of the gross pay. Fill in the following: Federal Tax (15%), Social Security Tax (6.2%), Medicare Tax (1.45%), State Tax (4%), and Pension (3%). Multiply the gross pay by each percentage to find the amount for each deduction.

- Sum all the deductions to get the Total Deductions. Enter this total in the corresponding field on the form.

- Finally, calculate the net pay by subtracting the Total Deductions from the Gross Pay. Write this amount in the Net Pay section.

- Review all entries for accuracy. Once confirmed, proceed to save your changes, download, print, or share the completed form as needed.

Start filling out your Net Pay Worksheet Answers online today!

Related links form

Gross wages – pretax deductions and nontaxable arrangements – taxes – after-tax deductions = net/take-home pay.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.