Get Ak 0405-200i 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK 0405-200i online

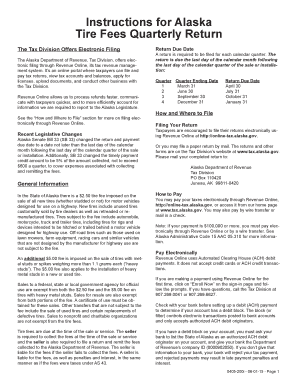

Filling out the AK 0405-200i form, also known as the Tire Fees Quarterly Return, is essential for taxpayers in Alaska to report tire sales accurately. This guide provides clear, step-by-step instructions to help users navigate the online form with ease.

Follow the steps to complete your Tire Fees Quarterly Return online.

- Press the ‘Get Form’ button to obtain the form. This will open the AK 0405-200i in the online editor where you can begin your entry.

- Enter the correct federal employer identification number (FEIN) or Social Security number (SSN) of the person filing the return. This information should match official records to avoid complications.

- Input the calendar quarter ending date for which you are filing the return. Ensure this is accurate so that your filing is aligned with the appropriate timeframe.

- Check the box if the filing is to amend a prior return. This is essential if you are correcting any previously filed information.

- Provide the seller’s name, mailing address, email address, phone number, and fax number. Accurate contact information ensures efficient communication if questions arise.

- List the contact person who is authorized to answer inquiries regarding the return, including their title and phone number.

- Complete the fee calculation section. Make sure to follow the specified line-by-line instructions to determine the number of new tires sold, including studded tires, and any exemptions.

- Include any required schedules or supporting documents with your return, ensuring they align with the totals reported.

- Sign and date the return. A return is not valid unless it is signed by the appropriate person authorized to represent the seller.

- Review all entries for accuracy before proceeding. Once confirmed, save any changes, then download, print, or share the completed form as necessary.

Complete your Tire Fees Quarterly Return online today to ensure compliance and streamline your filing process.

Related links form

Filling out a K-1 tax form involves several crucial steps; you'll need to provide your personal information and income details from the partnership or S corporation. Thankfully, accessing guides through the US Legal Forms platform can make this process smoother and ensure you don’t miss any important information. Following clear instructions will help you accurately report your earnings.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.