Loading

Get Form 5500-sf Short Form Annual Returnreport Of Small

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5500-SF Short Form Annual Return/Report of Small online

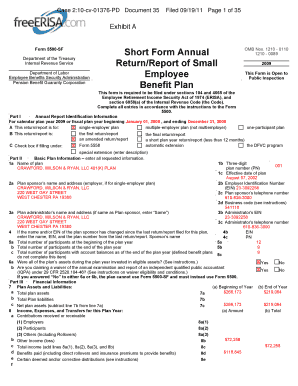

The Form 5500-SF is essential for small employee benefit plans to report relevant information about their financial condition and operations. This guide provides clear and concise instructions on how to complete this form online, ensuring compliance with regulatory requirements.

Follow the steps to complete the Form 5500-SF online effectively.

- Press the ‘Get Form’ button to access the Form 5500-SF and open it in your preferred online editor.

- Identify the plan year for which you are filing. Ensure that you specify if it’s for a calendar or fiscal year.

- In Part I, select the type of plan you are reporting for (e.g., single-employer, multiple-employer, one-participant). Also, indicate whether this is your first return, a final return, or an amended return.

- Complete Part II by providing the basic plan information, including the name of the plan, sponsor details, and relevant identification numbers.

- In Part III, fill in the financial information, including plan assets and liabilities along with income, expenses, and transfers for the specified plan year.

- Complete Part IV by detailing the characteristics of your plan. Include applicable feature codes, particularly if the plan provides pension or welfare benefits.

- Address compliance questions in Part V, ensuring you accurately state any incidents during the plan year that may affect compliance.

- For defined benefit plans, complete Part VI regarding pension funding compliance. Include necessary contribution information.

- If relevant, complete Part VII regarding plan terminations and the transfer of assets.

- Review all entries carefully for accuracy. After completion, you can save your changes, download the form, print it, or share it as needed.

Start filing your Form 5500-SF online today to ensure your employee benefit plan is compliant with regulations.

Generally, any business that sponsors a retirement savings plan must file a Form 5500 each year that the plan holds assets. Form 5500 Series reporting may also be required for certain employer-sponsored health and welfare plans, including medical, dental, life insurance and disability benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.