Loading

Get Form Nr73, Determination Of Residency Status ... - Go4visa.com

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form NR73, Determination Of Residency Status online

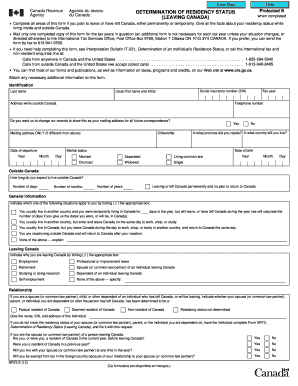

Filling out the Form NR73, Determination Of Residency Status, is an important process for individuals planning to leave Canada. This guide provides clear, step-by-step instructions to help users effectively complete the form, ensuring accurate representation of their residency status.

Follow the steps to successfully fill out the Form NR73.

- Press the ‘Get Form’ button to access the NR73 form.

- Begin by entering your personal identification details, including your last name, usual first name, social insurance number, and date of birth.

- Indicate your address while outside Canada and provide a telephone number for contact.

- Select your marital status from the provided options and specify the province where you resided in Canada prior to departure.

- Fill in the date of your departure and the tax year for which you are filing the form.

- In the 'Outside Canada' section, clarify how long you expect to live outside Canada, specifying the duration in days, months, or years.

- In the 'General Information' section, tick the appropriate box that best describes your living situation during the tax year.

- Explain your reason for leaving Canada in the 'Leaving Canada' section by selecting the most applicable response.

- If applicable, fill out the relationship section, indicating if you are a dependant and provide relevant details.

- Complete the 'Statement of Residency' by answering whether you are considered a resident of another country according to tax treaties.

- List any ties you will maintain in Canada while living abroad, marking the relevant boxes.

- Declare your intentions regarding returning to Canada or your long-term career goals in the designated sections.

- Review your information for accuracy and completeness before proceeding to the certification section.

- Certify the information by printing your name, signing, and dating the form.

- Save your changes and proceed to download, print, or share the completed form.

Complete your form NR73 online to ensure a smooth determination of your residency status.

Mail only one completed copy of this form for the tax years in question (an additional form is not necessary for each tax year unless your situation changes, or directed otherwise) to the International Tax Services Office, Post Office Box 9769, Station T Ottawa ON K1G 3Y4 CANADA.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.