Loading

Get Calculating Your Paycheck Salary Worksheet 1 Answer Key

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Calculating Your Paycheck Salary Worksheet 1 Answer Key online

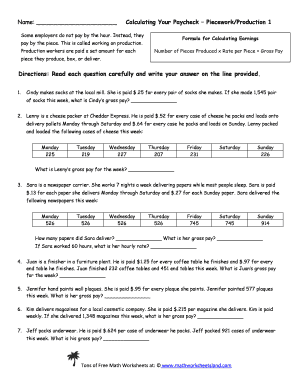

This guide provides clear and concise instructions for completing the Calculating Your Paycheck Salary Worksheet 1 Answer Key online. By following these steps, users can accurately calculate their gross pay based on piecework production.

Follow the steps to complete the worksheet effectively.

- Press the ‘Get Form’ button to access the worksheet in the online editor.

- Begin by reviewing the first instruction, which asks you to provide your name at the top of the form. Enter your name in the space provided.

- Read the directions carefully. The form is structured with questions related to piecework pay. Each question will provide specific scenarios for calculating gross pay.

- For each question, locate the answer line provided after the scenario and work out the calculations as instructed. Use the formula: Number of pieces produced x Rate per piece = Gross pay.

- After completing all calculations, ensure that you have filled out each question accurately, paying close attention to the rates and quantities given.

- Once all answers are provided, you can save your changes. Look for the options to download, print, or share the completed worksheet, depending on your preferences.

Start filling out your worksheet online today to ensure accurate calculations for your paycheck!

Multiply the hourly wage by the number of hours worked per week. Then, multiply that number by the total number of weeks in a year (52). For example, if an employee makes $25 per hour and works 40 hours per week, the annual salary is 25 x 40 x 52 = $52,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.