Loading

Get Co Td72-8-10 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CO TD72-8-10 online

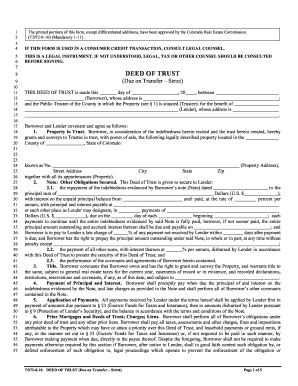

The CO TD72-8-10 form, known as the Deed of Trust, serves as a crucial legal instrument in real estate transactions in Colorado. This guide provides comprehensive steps on how to accurately complete this form online, ensuring users can navigate the process with confidence.

Follow the steps to successfully fill out the CO TD72-8-10 online

- Press the ‘Get Form’ button to access the CO TD72-8-10 form and open it in your preferred editing application.

- Begin by entering the current date in the designated field at the top of the form. This should reflect the day you are completing the document.

- In the sections labeled 'Borrower' and 'Lender,' provide the full names and addresses of all parties involved in the transaction. Ensure accuracy as this information is legally binding.

- For the 'Property in Trust' section, enter the legally described property address, including specific details like the street address, city, state, and zip code.

- Complete the 'Note: Other Obligations Secured' section, detailing any debts secured under this Deed of Trust. Fill in the principal sum of the loan, interest rates, and payment schedules as required.

- In the 'Title' section, affirm ownership of the property by the Borrower, noting any existing taxes, easements, or liens that are applicable.

- Continue through the form, addressing the obligations regarding payment of principal and interest, insurance requirements, and the responsibilities of the Borrower to maintain the property.

- Once all relevant fields are completed, review the form for accuracy. This includes checking all dates, names, and numerical values.

- Finally, save your changes, and utilize the available options to download, print, or share the completed CO TD72-8-10 form as needed.

Fill out your CO TD72-8-10 form online today to ensure a smooth real estate transaction.

Removing someone from a deed of trust often involves obtaining their consent and drafting an appropriate legal document. This can be accomplished through a Release of Deed of Trust or a similar form, depending on the situation. After all parties agree and sign the document, file it with your local county office to remove the individual from the deed effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.