Get Canada T2201 E 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T2201 E online

The Canada T2201 E is a crucial form for individuals seeking the disability tax credit. This guide provides a comprehensive approach on how to fill out the form online, ensuring all necessary information is accurately recorded.

Follow the steps to successfully complete the Canada T2201 E form.

- Press the 'Get Form' button to access the T2201 E document.

- Complete Part A of the form as the individual with the disability or their legal representative. Include personal information such as first name, last name, mailing address, date of birth, and social insurance number.

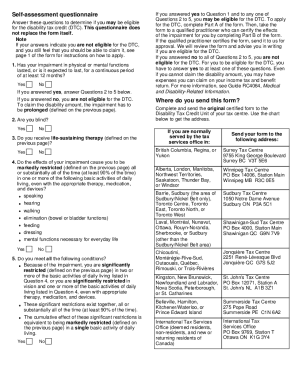

- Consult the self-assessment questionnaire in the introduction to determine eligibility for the disability tax credit. Note responses that may require further action in Part A.

- Once Part A is complete, take the form to a qualified practitioner who will fill out Part B. They will assess the impairment and certify its effects.

- After the qualified practitioner completes Part B, ensure all sections of the form are filled accurately.

- Submit the original certified form (both Part A and Part B) to your designated tax centre as indicated in the guidelines. Make sure to keep a copy for your records.

Begin filling out the Canada T2201 E form online today to access your disability tax credit.

Get form

Related links form

The income threshold for the Canada disability benefit may fluctuate based on government policies and your family composition. Typically, your eligibility for the benefit becomes clearer when you fill out the Canada T2201 E form, where income details are included. The rehabilitation and financial support offered through this benefit are designed to aid individuals with disabilities in achieving a more stable financial situation. To get the most accurate information, check the latest guidelines provided by the CRA.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.