Get Riversource Outgoing Non-qualified 1035 Exchange 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Riversource Outgoing Non-Qualified 1035 Exchange online

This guide provides a step-by-step approach to filling out the Riversource Outgoing Non-Qualified 1035 Exchange form. Whether you are a first-time user or familiar with such processes, this comprehensive guide will help you complete the form with confidence.

Follow the steps to successfully complete the 1035 exchange form.

- Press the ‘Get Form’ button to obtain the Riversource Outgoing Non-Qualified 1035 Exchange document and open it in your preferred editor.

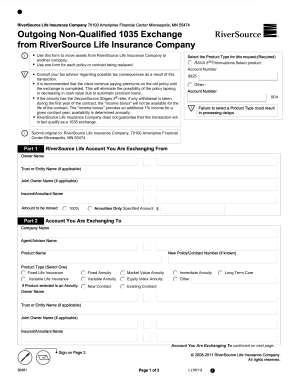

- Fill in Part 1 by providing details about the account you are exchanging from. Include the owner name, any applicable trust or entity name, joint owner name, insured or annuitant name, and the amount to be moved.

- In Part 2, select the product type you are exchanging to. Specify whether this is a fixed or variable life insurance, or an annuity. If you are choosing an annuity, provide additional details such as owner name, contract types, and account numbers.

- Complete the delivery instructions. Indicate who the check should be made payable to and provide the mailing address including city, state, and ZIP code.

- Proceed to the Absolute Assignment and Signature section. Confirm your assignment of rights to the new company. Sign and date the authorization and include any necessary signatures from joint owners or spouses if applicable.

- Check the letter of acceptance and surrender request section if applicable. This will be completed by a corporate officer of the new company. Ensure that contact information and other required details are accurately filled out.

- Review the entire form for accuracy and completeness. Save your changes, download the form for your records, print if necessary, or share it as needed.

Complete the Riversource Outgoing Non-Qualified 1035 Exchange form online to ensure a smooth transition of your assets.

The primary difference between qualified and non-qualified transfers lies in their tax treatment. Qualified transfers refer to accounts like IRAs that come with tax advantages, while non-qualified transfers, such as the Riversource Outgoing Non-Qualified 1035 Exchange, do not have the same benefits. Understanding this distinction can significantly affect your investment strategy. A thorough discussion with a financial expert can clarify these important differences.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.