Loading

Get Tsp-u-70 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TSP-U-70 online

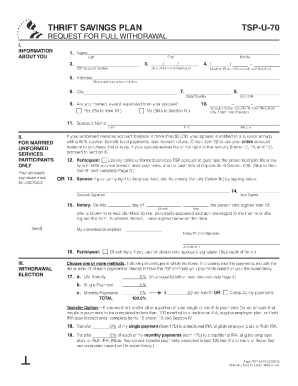

Filling out the TSP-U-70 form online is a straightforward process that requires attention to detail. This guide provides step-by-step instructions to make the experience efficient and user-friendly.

Follow the steps to successfully complete the form online.

- Click the ‘Get Form’ button to access the TSP-U-70 form and open it in the editor.

- Begin by entering your personal information in the designated fields, including your name, address, and contact details. Ensure that all entries are accurate to avoid any issues.

- In the following section, specify your TSP account number if applicable. If you do not have an account number, you may need to check the relevant box indicating this.

- Complete the section regarding your employment details, including your employer's name and your position. It is vital to provide current and precise information.

- Review the section that involves your contributions to the TSP plan. Make sure to fill in the percentage of your income you wish to contribute. This information is crucial for processing your contributions.

- Proceed to the section on beneficiary designation. It is important to specify who your beneficiary will be in case of unforeseen circumstances.

- Finally, review all information you have entered in the form for accuracy. Once everything is correct, you can save your changes, download the form, print it, or share it as needed.

Start completing your TSP-U-70 form online now!

Related links form

To report TSP withdrawals on your taxes, include details from your 1099-R form on your federal tax return. You will need to state the total amount of your TSP withdrawals and any tax withheld. Proper reporting ensures compliance with IRS regulations associated with TSP-U-70.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.