Loading

Get Form 8594

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8594 online

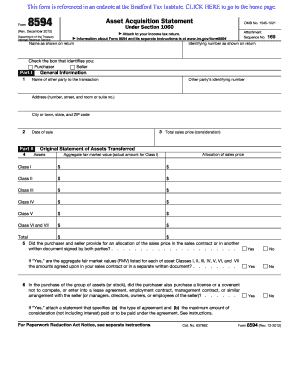

Filling out Form 8594, the Asset Acquisition Statement, is essential for reporting certain asset transfers for tax purposes. This guide will walk you through each section of the form to ensure you complete it accurately and efficiently.

Follow the steps to successfully complete Form 8594 online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering your name as it appears on your tax return and your identifying number. Select whether you are the purchaser or the seller by checking the appropriate box.

- In Part I, provide general information about the transaction. Include the name and identifying number of the other party, their address (including city, state, and ZIP code), the total sales price, and the date of the sale.

- In Part II, detail the original statement of assets transferred. Allocate the sales price across the different asset classes (I to VII) and ensure you enter both the total sales price for each class and the aggregate fair market value.

- Indicate whether the purchaser and seller have provided an allocation of the sales price in the sales contract or another written document. If 'Yes', confirm if the aggregate fair market values listed correspond with the amounts in the agreement.

- Answer whether the purchaser acquired a license, covenant not to compete, or any additional agreements related to the assets. If 'Yes', attach a statement that details the type of agreement and the maximum consideration involved.

- If you are amending a previously filed statement, complete Part III by providing the tax year and tax return form number previously filed. Report the previously allocated sales price and the new allocation for each asset class, indicating increases or decreases.

- Provide a summary of reasons for any increase or decrease in the allocation, attaching additional sheets if necessary.

- After filling out all relevant sections and reviewing for accuracy, save your changes. You may download, print, or share the completed form as required.

Complete Form 8594 online today and ensure your asset transfers are reported accurately for tax purposes.

Instructions for Form 8594 The form must be filed when a group of assets were transferred (in a trade or business), and if the buyer's basis in such assets is determined by the amount paid for the assets. This applies when the group of assets make up a trade, or business in the hands of the seller, the buyer, or both.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.