Loading

Get Business Debtor Questionaire - Office Of The Chapter 13 Standing

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Business Debtor Questionnaire - Office Of The Chapter 13 Standing online

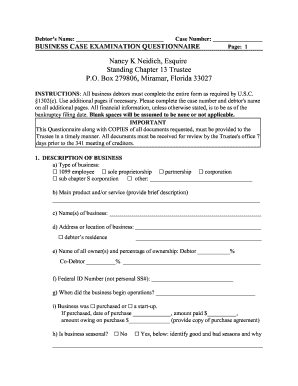

Completing the Business Debtor Questionnaire is a crucial step for business debtors filing under Chapter 13. This guide provides detailed, step-by-step instructions to help you fill out the form accurately and efficiently online.

Follow the steps to complete the form online

- Click ‘Get Form’ button to obtain the questionnaire and access it in your online editor.

- Begin by filling in your debtor's name and case number at the top of the form. Ensure that these details are included on any additional pages you may use.

- In the 'Description of Business' section, specify the type of business you operate. Select from options like 1099 employee, sole proprietorship, partnership, corporation, or subchapter S corporation, and add any other relevant description.

- Provide a brief description of your main product or service. This information should clearly outline what your business offers.

- List the names of the businesses and their locations, ensuring to indicate if the business address is the same as the debtor's residence.

- Detail the names of all owners and their respective percentages of ownership in the business.

- Fill in the federal ID number of the business, ensuring it is not your personal social security number.

- Indicate when the business began operations. Specify whether it was purchased or started up, including relevant dates and amounts if it was a purchase.

- Answer the question about seasonal operations and list the good and bad seasons if applicable.

- In the 'Description of Assets' section, estimate the value of physical assets, inventory, accounts receivables, and any goodwill associated with the business. Provide individual details for assets valued over $1,000 on a separate sheet.

- Confirm if you are leasing office space and business equipment. If yes, further detail about the lease and equipment must be submitted on a separate page.

- List all bank accounts accessible to the business and provide copies of bank statements and canceled checks for the three months prior to the Chapter 13 filing.

- Identify all employees by completing the necessary fields for each, including their position, salary, and employment type. Submit relevant payroll tax reports if applicable.

- In the licenses section, indicate if licenses are required for your business and submit copies of said licenses if applicable.

- Provide copies of your recent profit and loss statement and balance sheet.

- Finally, review the declaration under penalty of perjury section. Sign, date, and ensure your name is clearly written.

- Once you have completed all sections, you may save changes, download, print, or share the completed form as needed.

Complete your Business Debtor Questionnaire online to ensure a smooth Chapter 13 filing process.

About 96 percent of debtors who file under Chapter 7 receive a discharge of their debts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.