Loading

Get Form W-b8benb-e - Fatca - Hsbc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W-8BEN-E - FATCA - HSBC online

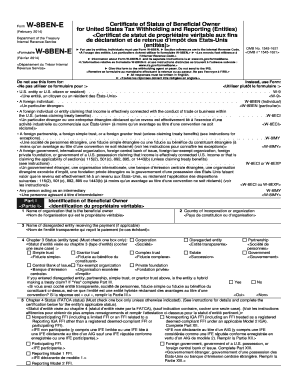

Filling out the Form W-8BEN-E is essential for foreign entities seeking to establish their status for United States tax withholding and reporting. This guide provides clear, step-by-step instructions to help users complete the form online with confidence.

Follow the steps to accurately fill out the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in Part I by providing the name of the organization that is the beneficial owner. Ensure to enter the correct legal name as recognized in your country of incorporation.

- Indicate the country of incorporation or organization in the designated field, ensuring accuracy as this will determine your tax obligations.

- If applicable, enter the name of any disregarded entity receiving the payment. This step is important for entities that receive payments on behalf of the beneficial owner.

- Select the chapter 3 status by checking one box only that corresponds to the entity type. Options include corporation, partnership, or trust, among others.

- Complete the chapter 4 status section by checking one box only that reflects the entity’s FATCA status. Review the instructions to ensure the correct selection.

- Provide the permanent residence address, avoiding post office boxes. If the mailing address differs, fill in that section accordingly.

- If required, enter the U.S. taxpayer identification number (TIN), which applies to certain entities. If not applicable, this may be left blank.

- Fill in the GIIN (Global Intermediary Identification Number) if applicable, as this is critical for compliance with FATCA.

- Continue to fill out the remainder of the form, including necessary certifications related to tax treaty benefits if applicable.

- Finally, review the entire form for accuracy and completeness before submitting it. Ensure all required sections are filled out.

- Once completed, save the changes, and download, print, or share the form as needed.

Complete your Form W-8BEN-E online for seamless processing of your tax information.

You may be exempt from FATCA if you have a beneficial interest in what the IRS recognizes as a foreign trust or a foreign estate. However, ownership of a foreign trust or foreign estate is, unfortunately, not a get-out-of-jail-free card.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.