Loading

Get Vat Declaration Form Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VAT Declaration Form PDF online

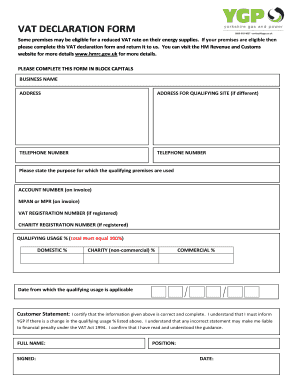

Completing the VAT Declaration Form is essential for premises eligible for a reduced VAT rate on energy supplies. This guide provides straightforward steps to help you fill out the form accurately and efficiently online.

Follow the steps to fill out the VAT Declaration Form PDF.

- Click the ‘Get Form’ button to obtain the VAT Declaration Form and open it in your preferred PDF editor.

- Fill in the 'Business Name' and 'Address' fields with accurate, up-to-date information in block capitals.

- If the address for the qualifying site differs from the business address, enter it in the designated field.

- Provide your 'Telephone Number' in the space provided to ensure contactability.

- State the purpose for which the qualifying premises are used in the appropriate section.

- Enter your 'Account Number,' found on your invoice, in the designated box.

- Fill in the 'MPAN or MPR' as indicated on your invoice, carefully ensuring accuracy.

- If your business is VAT registered, include your 'VAT Registration Number' in the relevant section.

- If applicable, enter your 'Charity Registration Number' in the space provided.

- Indicate the 'Qualifying Usage %' by providing values for Domestic, Charity (non-commercial), and Commercial categories, ensuring the total equals 100%.

- Specify the 'Date from which the qualifying usage is applicable' to indicate when the rates apply.

- Review the 'Customer Statement' section, confirming that the information provided is correct and complete, and that you understand your obligations.

- Sign your name in the 'Signed' field, include your 'Position,' and write the 'Date' of completion.

- Once you have filled out all sections, save your changes, and download or print the completed form as needed.

Complete your VAT Declaration Form PDF online today to ensure compliance and potential savings on energy supplies.

You may be able to get a VAT refund if you're only traveling to Great Britain in order to change planes. You must be travelling to a non EU country and the goods must be in your hold luggage at all times. Check the rules on bringing goods into Great Britain.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.