Loading

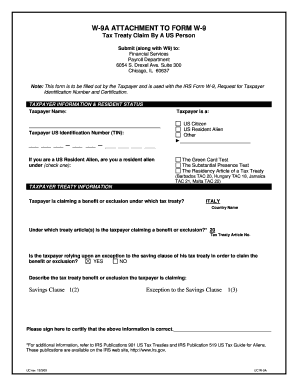

Get W9a Attachment To Form W9 Tax Treaty Claim By A Us Person Submit (along With W9) To: Financial

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W9A attachment to form W9 tax treaty claim by a US person submit (along with W9) to: Financial online

The W9A attachment to form W9 is essential for US persons claiming tax treaty benefits or exclusions. This guide offers a clear and structured approach to filling out the form accurately and efficiently.

Follow the steps to complete the W9A attachment accurately.

- Click 'Get Form' button to access the W9A attachment and open it in your preferred editor.

- In the 'Taxpayer Information & Resident Status' section, enter your full name as it appears on your tax documents.

- Choose your status by marking the appropriate box: US Citizen, US Resident Alien, or Other.

- Move to the 'Taxpayer Treaty Information' section and indicate the country of the tax treaty you are claiming benefits under.

- Select whether you are relying upon an exception to the saving clause, and provide a brief description of the tax treaty benefit or exclusion you are claiming.

- Lastly, review the content for accuracy and sign the document to certify that all information provided is correct.

- Once you have filled out the form, you can save your changes. Options to download, print or share the completed form will be available in your editor.

Complete your documents online with ease and ensure you have everything in order for your tax submission.

Related links form

Only US-based companies need to collect Forms W-8 or W-9. If a company is based outside of the US, there's no need to collect them.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.