Loading

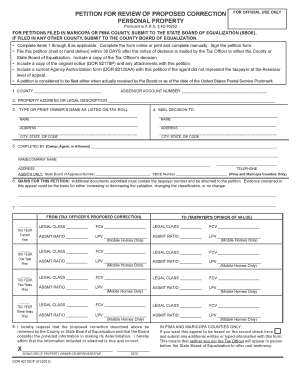

Get Petition For Review Of Proposed Correction For Official - Azdor

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the petition for review of proposed correction for official - Azdor online

Filling out the petition for review of proposed correction for official - Azdor can seem daunting, but this guide aims to simplify the process. Whether you are a property owner or an agent, understanding each section of the form will help ensure that your petition is completed accurately and submitted in a timely manner.

Follow the steps to efficiently complete your petition online.

- Use the 'Get Form' button to access the petition for review form and open it in your preferred editor.

- Begin filling out the form by entering your county in the designated field. Ensure that you have all relevant information available.

- Input your assessor account number to help identify your property accurately.

- Provide the property address or legal description in the appropriate section. This information is crucial for identifying the property in question.

- Type or print the owner's name as it appears on the tax roll. This ensures that your information matches official records.

- Indicate where you would like the decision to be mailed by providing the recipient’s name and address, including city, state, and zip code.

- Complete the 'Completed By' section to identify who is submitting the petition, whether it is the owner, an agent, or an attorney. Include necessary contact details.

- Explain the basis for the petition in the designated area. Include any additional documents that support your appeal.

- Provide the tax officer's proposed correction details and your opinion of value, including all tax year categories and necessary classifications.

- Sign the petition at the bottom, affirming that the information provided is true and correct. Ensure to include the date of signing.

- For residents of Pima and Maricopa counties, check the box if you wish for your appeal to be heard on the record without personal appearances.

- After completing the form, review it for any errors. Then, save your changes in the editor, and choose to download, print, or share it accordingly based on your submission needs.

Take the next step in your property appeal process by completing the petition online today.

"The Arizona Department of Revenue does not call to demand immediate payment or call about taxes owed without having initial communication with them through the mail." Arizonans with tax-related ID theft questions should contact the ADOR's identity theft call center or the Internal Revenue Service.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.