Loading

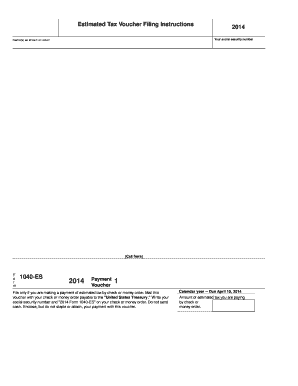

Get Estimated Tax Voucher Filing Instructions 2014 Your Social Security Number Name(s) As Shown On

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Estimated Tax Voucher Filing Instructions 2014 Your Social Security Number Name(s) As Shown On online

Filling out the Estimated Tax Voucher is essential for individuals making estimated tax payments. This guide provides clear instructions on how to correctly complete the form to ensure proper processing of your payments.

Follow the steps to accurately fill out the form and submit your payment.

- Click ‘Get Form’ button to obtain the form and open it in the specified editor.

- Enter your social security number in the designated field. Ensure that the number is accurate to avoid any processing issues.

- Fill in your name(s) as shown on your tax return. This should match the records on file with the Internal Revenue Service.

- Indicate the amount of estimated tax you are paying by check or money order. Ensure that this amount is reflective of what you have calculated for your estimated taxes.

- Note the due date for your payment, which varies by the quarter for which you are making the estimated tax payment. For instance, payments due in 2014 will have specific dates: April 15, June 17, September 16, and January 15 of the following year.

- Prepare your check or money order, making it payable to the 'United States Treasury.' It's important to write your social security number and '2014 Form 1040-ES' on the payment instrument.

- Do not send cash. Enclose but do not staple or attach your payment with the voucher.

- After completing all fields, review the information for accuracy. You can then save changes, download, print, or share the completed form as necessary.

Complete your documents online today to ensure timely submission of your estimated tax payments.

The IRS says to put your Social Security number on the memo line of a check when sending in a payment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.