Get Uk Hmrc P87 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign UK HMRC P87 online

How to fill out and sign UK HMRC P87 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

The preparation of legal documents can be costly and labor-intensive. Nevertheless, with our pre-designed online templates, the process becomes more straightforward.

Currently, preparing a UK HMRC P87 takes no more than 5 minutes. Our state-of-the-art web forms and comprehensive guidelines eliminate errors that are prone to human oversight.

Utilize the quick search and advanced cloud editor to create an accurate UK HMRC P87. Eliminate the routine and generate documents online!

- Select the online template from the catalog.

- Fill in all necessary information in the designated fillable fields. The user-friendly drag-and-drop interface enables you to add or rearrange fields.

- Ensure that everything is correctly completed, without errors or missing sections.

- Apply your electronic signature to the document.

- Click Done to finalize the modifications.

- Download the documents or print your version.

- Send directly to the recipient.

How to Modify Get UK HMRC P87 2014: Personalize Forms Online

Utilize our robust online document editor while finalizing your documentation. Fill out the Get UK HMRC P87 2014, mark the most crucial details, and seamlessly make any required changes to its content.

Preparing documents digitally not only saves time but also provides the chance to alter the template to meet your needs. If you're about to work on Get UK HMRC P87 2014, consider completing it with our comprehensive online editing tools. Whether you misspell a word or input the requested information into the incorrect field, you can swiftly adjust the form without the need to start over as you would with manual entry. Additionally, you can highlight the essential information in your document by marking specific pieces of content with colors, underlining them, or encircling them.

Follow these straightforward and rapid steps to complete and modify your Get UK HMRC P87 2014 online:

Our powerful online solutions are the easiest way to complete and personalize Get UK HMRC P87 2014 according to your needs. Use it to handle personal or professional documentation from anywhere. Open it in a browser, make any alterations to your forms, and return to them at any time in the future - they'll all be securely stored in the cloud.

- Open the form in the editor.

- Input the required information in the empty fields using Text, Check, and Cross tools.

- Follow the form navigation to ensure no crucial fields in the template are overlooked.

- Circle some of the essential details and add a URL to them if needed.

- Utilize the Highlight or Line tools to accentuate the most important pieces of content.

- Select colors and thickness for these lines to ensure your form appears professional.

- Erase or blackout the information you do not wish others to see.

- Replace erroneous content and input the text you require.

- Conclude modifications using the Done option when you're certain everything is accurate in the form.

Related links form

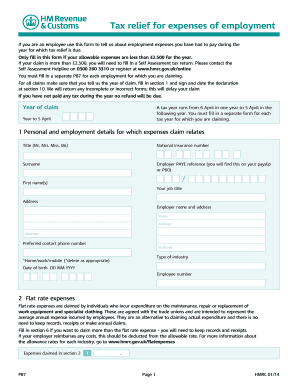

Being eligible for UK tax relief means you can qualify to reduce your taxable income through specific allowable expenses. This relief can apply to a range of costs including those related to your work-from-home setup in the UK HMRC P87 form. It is essential to carefully review the criteria to determine your eligibility and maximize your tax benefits.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.