Loading

Get Uk Hmrc P87 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC P87 online

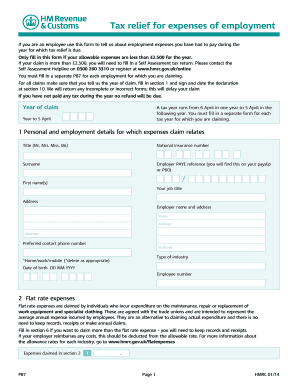

The UK HMRC P87 form is essential for employees seeking tax relief on employment-related expenses. This guide provides clear, step-by-step instructions to help you accurately complete the form online, ensuring a smooth submission process and potential refund.

Follow the steps to successfully complete your P87 online.

- Press the ‘Get Form’ button to obtain the P87 form and open it in your editor.

- Indicate the year of claim, which runs from 6 April in one year to 5 April in the next. Complete section 1 with your personal and employment details, including your title, surname, National Insurance number, and employer details.

- In section 2, report any flat rate expenses you wish to claim. Enter the total amount in the relevant box and refer to HMRC guidelines for industry-specific rates.

- Proceed to section 3 for vehicle expenses. Specify the type of vehicle used for work and document your total business mileage. Calculate allowances based on the applicable rates detailed in the form.

- Complete section 4 for any professional subscriptions paid during the tax year. List the professional body and the amounts paid.

- Fill out section 5 to claim any hotel and meal expenses incurred during business trips. Record the dates, locations, and amounts spent.

- Section 6 is for other expenses related to your employment that do not fall under prior categories. Document any other relevant expenses, ensuring you adhere to HMRC guidelines.

- In section 8, calculate your total expenses by adding all the allowable expenses from previous sections, excluding any repayment amounts. Ensure the total does not exceed £2,500.

- In section 9, indicate your preferred payment method for any refund. Provide the necessary bank details or designate a nominee if applicable.

- Conclude with section 10 by signing and dating the declaration, attesting that the information provided is truthful and complete to the best of your knowledge.

- Once completed, save your changes, and you may download, print, or share the form as needed.

Submit your P87 form online for potential tax relief on your employment expenses today.

Being eligible for UK tax relief means you can qualify to reduce your taxable income through specific allowable expenses. This relief can apply to a range of costs including those related to your work-from-home setup in the UK HMRC P87 form. It is essential to carefully review the criteria to determine your eligibility and maximize your tax benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.