Get Use This Form To Take Advantage Of Pioneers Automated Rmd

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Use This Form To Take Advantage Of Pioneers Automated RMD online

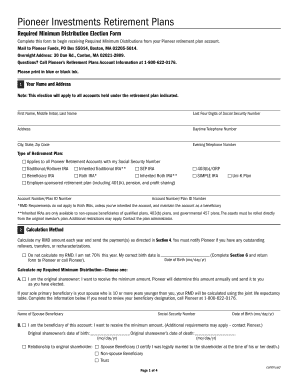

Completing the Required Minimum Distribution Election Form is essential for individuals aged 70½ and older to manage their retirement plan accounts effectively. This guide provides clear, step-by-step instructions on how to fill out the form online to ensure compliance with federal requirements while taking advantage of your retirement benefits.

Follow the steps to complete your Required Minimum Distribution Election Form.

- Press the ‘Get Form’ button to access the Required Minimum Distribution Election Form. Ensure the form is opened in your preferred editor.

- Fill in your personal information in Section 1. This includes your full name, Social Security number, address, and telephone numbers. It is crucial to ensure accuracy in this section.

- Select the type of retirement plan you are applying for under Section 1. Mark the appropriate box that corresponds to your account type, such as Traditional IRA or Roth IRA.

- In Section 2, choose your preferred calculation method for your RMD. Decide whether you want Pioneer to calculate your RMD or if you do not need to calculate it this year. If applicable, complete the date of birth field for correct calculations.

- Section 3 requires you to select your payment schedule. Decide if you are establishing a new systematic withdrawal plan (SWP) or changing an existing one. Mark your preferred frequency for payments.

- In Section 4, specify where you want your payments to be sent. You can choose to have payments sent to your bank account, a Pioneer non-retirement account, or to the address listed in Section 1. If choosing to send to a bank, provide the required banking information.

- Complete Section 5 by addressing withholding elections for federal income tax. Decide whether you want to waive withholding or specify a deduction percentage.

- Sign and date the form in Section 6, confirming your understanding and acceptance of the tax consequences of your election. Ensure you follow up with any necessary employer authorization if applicable.

- Submit the completed form to Pioneer Funds either by mailing it to the provided address or electronically, if applicable.

- Finally, save any changes you made to the document before submitting. You may also download, print, or share the form as needed.

Complete your Required Minimum Distribution Election Form online today to ensure you manage your retirement distributions effectively.

Related links form

The SECURE Act of 2019 changed the age at which RMDs begin from 70½ to 72. Secure 2.0 increases the age at which RMDs begin to age 73 for those individuals who turn 72 on or after January 1, 2023. Notably, an individual who attains age 72 in 2023 is not required to take an RMD for 2023.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.