Loading

Get Daycare Chart Of Accounts

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Daycare Chart Of Accounts online

Filling out the Daycare Chart Of Accounts is an important step for ensuring accurate financial tracking for your daycare. This guide provides clear, step-by-step instructions on each section of the form, helping you navigate the online process with ease.

Follow the steps to complete your Daycare Chart Of Accounts online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

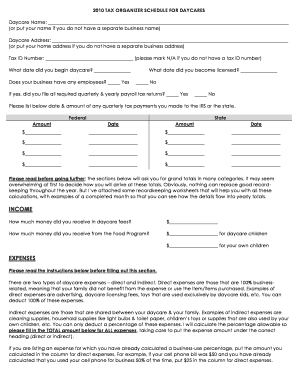

- Begin by entering your daycare name. If you do not have a separate business name, you can input your personal name in this field.

- Next, provide your daycare address. If you operate from home, use your home address here.

- Fill in your Tax ID Number, marking N/A if you do not possess one.

- Indicate the date on which you began your daycare services.

- Answer whether your business has any employees, selecting 'Yes' or 'No'.

- Record the date you became licensed, if applicable.

- If your business has employees, confirm if you have filed all required quarterly and yearly payroll tax returns.

- List the date and amount of any quarterly tax payments made to the IRS or the state, separated into federal and state sections.

- Complete the income section by entering the total daycare fees received and amounts received from the Food Program for both daycare children and your own children.

- Proceed to the expenses section, distinguishing between direct and indirect expenses. Fill in the total amounts for various categories, ensuring to provide supporting documentation where necessary.

- List any major purchases over $100, including a description, date of purchase, cost, and the percentage used in daycare.

- Fill out the food expenses section detailing the number of children served for each meal, excluding your own children.

- Complete the operating hours section by documenting the total childcare hours and other business hours for each month.

- If applicable, provide details on auto expenses, including the date you began using your vehicle for business, and the total business, commuting, and personal miles driven.

- Once all sections are completed, review your entries for accuracy. You can then save changes, download, print, or share the form as needed.

Start filling out your Daycare Chart Of Accounts online today to streamline your financial management.

How does a chart of accounts work? In a chart of accounts, accounts are shown in the order that they appear on your financial statements. Consequently, assets, liabilities, and shareholders' equity (balance sheet accounts) are shown first, followed by revenue and expenses (income statement accounts).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.