Loading

Get St105d Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St105d Form online

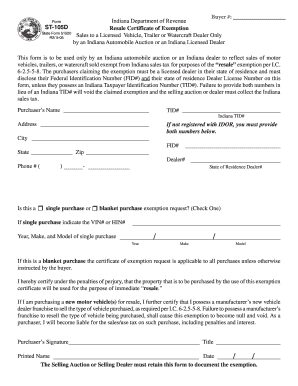

The St105d Form is a critical document for licensed vehicle, trailer, or watercraft dealers in Indiana who wish to claim a resale exemption from sales tax. This guide provides a clear, step-by-step approach to filling out the form online effectively.

Follow the steps to complete the St105d Form online.

- Use the ‘Get Form’ button to access the St105d Form and open it in your online editor.

- Begin by entering the buyer number in the designated space at the top of the form. This number is essential for tracking and identification purposes.

- Complete the Purchaser's Name field by entering the name of the individual or organization making the purchase.

- Enter the Indiana Taxpayer Identification Number (TID#) if applicable, or provide the Federal Identification Number (FID#) along with the State of Residence Dealer License Number.

- Fill in the address fields, including street address, city, state, and zip code. Ensure all information is accurate to prevent processing delays.

- Indicate whether this is a single purchase or a blanket purchase exemption request by checking the corresponding box.

- If this is a single purchase, provide the Vehicle Identification Number (VIN#) or Hull Identification Number (HIN#), along with the year, make, and model of the vehicle or watercraft.

- Read and certify the statement regarding the purpose of the purchase for immediate resale. This certification confirms your compliance with the exemption requirements.

- Sign the form by entering your name, title, and the date. Ensure your signature is clear, as this validates the exemption.

- Once all sections are completed, you can save your changes, download the document, print it, or share the form as necessary.

Complete your St105d Form online today to expedite your resale exemption process.

To get a resale certificate in Indiana, you will need to fill out the Indiana General Sales Tax Exemption Certificate (ST-105). How often should this certificate be renewed? It appears that a blanket certificate in Indiana does not expire.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.