Get Wa Commerce Form 24b 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WA Commerce Form 24B online

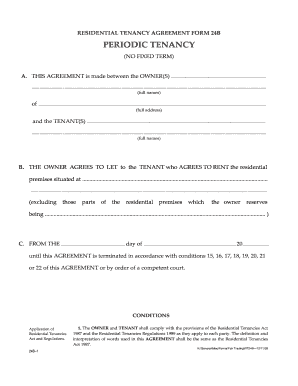

Filling out the WA Commerce Form 24B online can seem challenging, but with the right guidance, the process can be straightforward. This form is essential for establishing a periodic tenancy and outlines the rights and responsibilities of both the owner and tenant.

Follow the steps to familiarize yourself with the form.

- Click the ‘Get Form’ button to obtain the form. This will allow you to access the document in a digital format for easy completion.

- Begin by filling in the first section, which includes the full names of the owner(s) and their address. Ensure that all names are legibly written and correctly spelled to avoid discrepancies.

- Next, provide the names of the tenant(s) in the designated area. This section should mirror the information from the owners to maintain consistency.

- In the following section, specify the residential premises' address. This detail is crucial as it identifies the property involved in the agreement.

- State the starting date of the tenancy. Ensure that the date is written clearly and accurately, as this marks the beginning of the rental period.

- Proceed to the conditions section, where both the owner and tenant agree to comply with the Residential Tenancies Act. Revisit this section to understand rights and obligations.

- Complete the payment details section, including the agreed rent amount and the payment frequency. Be precise regarding the figures to prevent any future misunderstandings.

- Once all fields are filled, review the form for any inaccuracies or missing information. Ensuring that everything is correct will aid both parties in avoiding disputes.

- Finally, save your changes, then download or print the form for your records. You may also choose to share the form with involved parties as needed.

Complete your WA Commerce Form 24B online today for a seamless rental agreement experience.

Calculating Washington B&O tax involves determining your gross income and applying the appropriate rate based on your business classification. Each business type has distinct tax rates that impact the calculation. Utilizing the WA Commerce Form 24B can help interpret these requirements effectively and ensure you meet your tax obligations. Being informed about these regulations is crucial for keeping your business compliant.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.