Loading

Get Form 54 Claims

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 54 Claims online

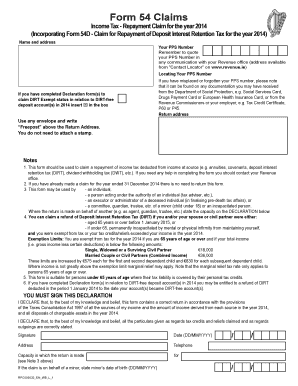

Filling out the Form 54 Claims online can be straightforward if you follow the steps outlined in this guide. This document is designed to help you navigate the process of claiming a repayment of income tax effectively.

Follow the steps to complete the Form 54 Claims online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your name and address in the designated fields. Ensure that this information is accurate for correspondence.

- Enter your Personal Public Service (PPS) Number as requested. Remember to refer to this number in any communication with your revenue office.

- Complete the Declaration section by marking the box if you have filed any Declaration form(s) for DIRT Exempt status related to DIRT-free deposit accounts in 2014.

- Include the Return address clearly, and remember, there’s no requirement to attach a stamp if you use a Freepost envelope.

- List all sources of income for the year 2014 in the income section. Be specific and attach any relevant certificates or vouchers as required.

- Provide details about the tax credits you are claiming. Fill out the appropriate sections based on your situation, marking the necessary options.

- Complete the Capital Gains section if applicable by detailing any chargeable assets and the necessary financial figures.

- Input your bank details accurately to facilitate repayment transfers. Include both IBAN and BIC codes for proper processing.

- Review all provided information for accuracy and completeness. Ensure you sign and date the declaration at the end.

- Finally, save your changes, and choose whether to download, print, or share the completed form.

Complete your Form 54 Claims online today to ensure a smooth filing process.

Opening the Form 11 Login to ROS, then click on the “Complete a Form On-line” under the “File A Return” heading. Select “Income Tax” from the tax type dropdown box, then select “Form 11” and click the “File Return” button. Select the period you wish to file from the dropdown menu and click “Next”.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.