Loading

Get Direct Deposit Information - Peoplenet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Direct Deposit Information - PeopleNet online

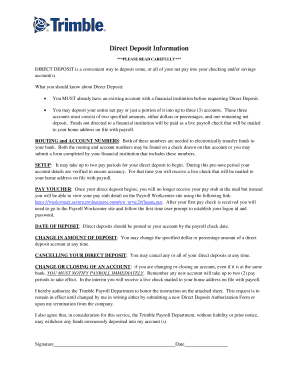

Filling out the Direct Deposit Information form is a straightforward process that allows you to conveniently have your net pay deposited directly into your chosen bank account(s). This guide provides you with clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete your Direct Deposit Information form

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in your employee name in the designated area at the top of the form.

- Determine if you are setting up a new account, making a change to an existing account, or canceling a partial deposit. Select the appropriate option by marking the box beside the option.

- For a new account setup, enter the routing number for the account where you want your full net deposit or partial deposits sent.

- If you are setting up partial deposits, specify the dollar amount for the first and/or second partial deposit and ensure you enter the correct routing numbers for these accounts.

- Indicate whether each account is a checking or savings account by circling the appropriate option next to the account numbers.

- If you are changing an existing direct deposit, fill in the new deposit amounts and the corresponding routing numbers as stated in the previous steps.

- If you are canceling or closing an account, complete the relevant sections to remove any existing partial deposits.

- Remember to attach a voided check for all accounts listed above, as this is crucial for the verification process.

- Review all the entered information for accuracy before submitting.

- Finally, save any changes, download, print, or share the completed form, as necessary.

Complete your Direct Deposit Information form online today to ensure a smooth and hassle-free payment process.

Direct deposit downsides You can't stop payment, as you can with a paper check. Changing banks means changing direct deposit information—employees need to complete new authorizations forms. There may be some initial costs to set up accounts and direct deposit bookkeeping software.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.