Loading

Get Hmrc Ca8421 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HMRC CA8421 online

The HMRC CA8421 is a crucial form for individuals and businesses dealing with tax matters in the UK. This guide offers a comprehensive overview of how to accurately complete this document online, ensuring a smooth filing process.

Follow the steps to successfully fill out the HMRC CA8421 form

- Click the ‘Get Form’ button to obtain the HMRC CA8421 form and open it in your preferred editing tool.

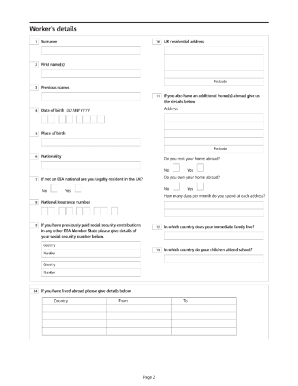

- Begin by entering your personal information in the designated fields. This includes your name, address, and any relevant identification numbers.

- Review the sections pertaining to your financial details. Ensure that the information provided is accurate and matches your records.

- If applicable, provide details regarding any partners or stakeholders. Be sure to use neutral terms and keep the focus on the individuals involved.

- Complete any additional required sections, such as declarations or agreements. Follow the instructions carefully, and avoid rushing through these sections.

- Once you have filled out all necessary sections, take the time to review your entries. Confirm that all information is complete and free from errors.

- Finally, you can save your changes, download your completed form, print it for your records, or share it as needed.

Start filling out your HMRC CA8421 form online today!

Yes, HMRC has access to various systems that can indicate when individuals travel abroad or live outside the UK. They may reach out to discuss how your overseas experiences affect your tax obligations. Monitoring compliance with regard to HMRC CA8421 is crucial if you are spending significant time outside the country.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.