Loading

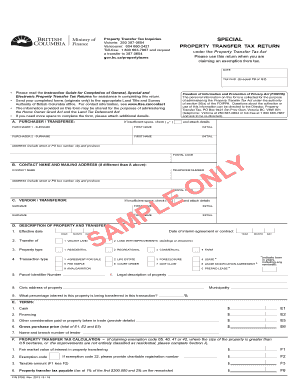

Get Fin 579s Sample Special Property Transfer Tax Return This Is A Sample Version Of A Special Property

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FIN 579S Sample Special Property Transfer Tax Return online

This guide provides clear, step-by-step instructions for completing the FIN 579S Sample Special Property Transfer Tax Return, a crucial form for claiming an exemption from property transfer tax. By following these instructions, you can successfully navigate the process online.

Follow the steps to complete your tax return accurately.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering the date of the transaction in the designated field to ensure accurate record-keeping.

- Fill in the purchaser's information, including surname, first name, and initial for both purchaser 1 and purchaser 2. Ensure the address is complete, with street or PO box number, city, province, and postal code.

- If different from the above, provide the contact name and mailing address in the relevant fields, along with a telephone number.

- Next, enter the vendor's information, including their surname, first name, and any supplementary details if required.

- Describe the property being transferred by providing the effective date, property type, and transaction type. Indicate clearly whether the property is residential, commercial, or another category.

- Fill out the financial information section, detailing cash amounts, financing, and any other considerations related to the transaction.

- Calculate the property transfer tax by entering necessary figures and following the provided formulas in the form.

- Complete the additional information section as prompted, describing relationships between transferor and transferee where applicable.

- Finally, verify all entered information is complete and accurate. Once satisfied, you can save changes, download, or print the form as necessary before submission.

Start filling out your FORM online today to ensure a smooth property transaction process.

A transfer tax is charged by a state or local government to complete a sale of property from one owner to another. The tax is typically based on the value of the property. A federal or state inheritance tax or estate tax may be considered a type of transfer tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.