Loading

Get Ca Form 3592

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Form 3592 online

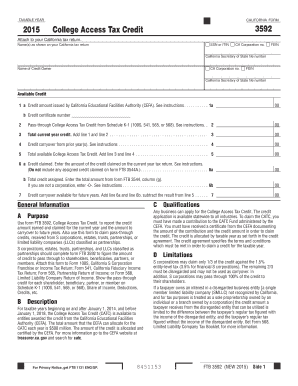

Filling out CA Form 3592 online requires attention to detail and understanding of various components related to the College Access Tax Credit. This guide will walk you through the necessary steps to complete and submit the form accurately.

Follow the steps to successfully complete the CA Form 3592 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), or identify your California Corporation number or Federal Employer Identification Number (FEIN). Ensure the information matches what is shown on your California tax return.

- Provide your name as it appears on your California tax return, followed by providing the California Secretary of State file number for your corporation or entity, if applicable.

- Proceed to the ‘Available Credit’ section. For line 1a, enter the credit amount issued by the California Educational Facilities Authority () as per your Credit Allocation Agreement. If not claiming from , skip line 1a.

- For line 2, record the total amount of pass-through College Access Tax Credit you received from pass-through entities. If applicable, ensure you list all relevant entities.

- Calculate your total current year credit by adding lines 1 and 2. Enter the sum on line 3.

- Enter any credit carryover from previous years on line 4.

- Sum lines 3 and 4 to determine your total available College Access Tax Credit on line 5.

- On line 6a, input the amount of credit you are claiming for the current year. Remember not to include any assigned credits. Refer to your tax liability to accurately adjust this amount if necessary.

- For line 6b, enter the total credit assigned as indicated from form FTB 3544, column (g). If you are not a corporation, enter -0-.

- Calculate the credit carryover available for future years by adding lines 6a and 6b, then subtract this total from line 5. Enter the result on line 7.

Complete your documents online today for a smoother filing experience.

Use form FTB 3592, College Access Tax Credit, to report the credit amount earned and claimed for the current year and the amount to carryover to future years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.