Loading

Get Merchant Cash Advance Application Checklist

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Merchant Cash Advance Application Checklist online

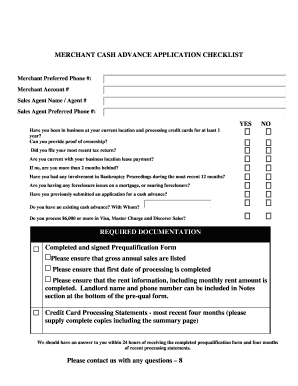

Filling out the Merchant Cash Advance Application Checklist is a crucial step for businesses seeking financial assistance. This guide provides clear and professional instructions to help you complete the form online efficiently.

Follow the steps to complete the form accurately.

- Click the ‘Get Form’ button to obtain the Merchant Cash Advance Application Checklist and open it in your chosen editor.

- Begin by entering the merchant name, preferred phone number, and merchant account number at the top of the form. This information is essential for identification.

- Next, fill in the sales agent's name, agent number, and preferred phone number to ensure proper communication throughout the application process.

- Respond to the yes/no questions regarding your business's current operations, bankruptcy involvement, and existing cash advances. Be truthful and provide necessary explanations if required.

- Throughout the required documentation section, ensure the prequalification form is completed. Take care to list gross annual sales accurately, provide the first date of processing, and include landlord details if applicable.

- Attach the credit card processing statements for the last four months, making sure to include complete copies, including any summary pages.

- Complete the merchant pre-qualification form, paying special attention to your business legal name, DBA name, and type of business entity.

- Enter your physical and billing addresses accurately along with the contact phone numbers. Ensure that the city, state, and zip code are correct.

- Fill in the gross annual sales figure from the previous year's tax return and the processing volumes for the four most recent months of credit card transactions, including average monthly volumes.

- The owner/officer must print their name, sign, and date the form to formally complete the application.

- Once you have filled in all necessary fields, review your application for accuracy. After ensuring all information is correct, you can save changes, download, print, or share the form as needed.

Take the first step towards securing your merchant cash advance by completing the application online today.

It's a fairly straightforward process to calculate factor rates. Simply multiply the principal amount you're borrowing by your factor rate. For example, if you're borrowing $1,000 at a 1.3 rate, multiply 1,000 x 1.3 and you'll find that you will be paying $1,300 for your loan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.