Loading

Get Mi Self-employment Income And Expense Statement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI Self-Employment Income and Expense Statement online

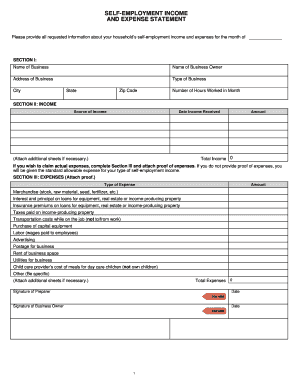

The MI Self-Employment Income and Expense Statement is essential for documenting your business income and expenses. This guide will assist you in completing the form accurately and efficiently online.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to acquire the MI Self-Employment Income and Expense Statement and open it in your editor.

- In Section I, fill out your business details, including the name of your business, name of the business owner, business address, type of business, city, state, zip code, and the number of hours worked in the month.

- Proceed to Section II, where you will report your income. List the source of income, the date the income was received, and the amount. Make sure to add additional sheets if required. At the end of this section, calculate and enter the total income.

- If you choose to claim actual expenses, move to Section III and provide a detailed list of types of expenses and their amounts. Attach proof of these expenses as necessary. Ensure to document costs related to merchandise, labor, advertising, utilities, etc. Remember to be specific with any 'Other' expenses.

- Finally, sign and date the form as the preparer, and also have the business owner sign and date the document. Ensure that all information is accurate before proceeding.

- Once all sections are completed, you can save changes, download or print the form, or share it if required.

Start completing your MI Self-Employment Income and Expense Statement online today!

Reporting self-employment expenses requires you to catalog all business-related costs accurately. Make sure to categorize these expenses, providing clear descriptions and amounts. This organized approach not only helps you keep your financial records in order but is also essential for completing the MI Self-Employment Income and Expense Statement successfully.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.