Loading

Get Nevada Ifta Tax Return By Fax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nevada Ifta Tax Return By Fax Form online

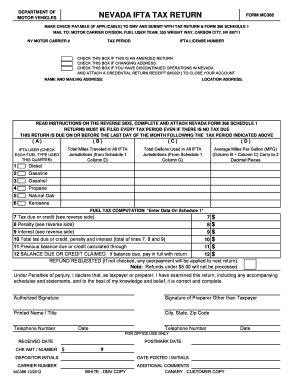

The Nevada Ifta Tax Return By Fax Form is essential for carriers licensed as Nevada-based IFTA carriers to report their fuel usage and tax obligations. Filling it out correctly ensures compliance and avoids penalties.

Follow the steps to complete your Nevada Ifta Tax Return By Fax Form online.

- Select the ‘Get Form’ button to retrieve the Nevada Ifta Tax Return By Fax Form and view it in your editing application.

- Fill in your Nevada motor carrier number and the tax period corresponding to your reporting.

- If applicable, check the boxes for amended returns, address changes, or discontinuation of operations in Nevada.

- Input your name and complete mailing address accurately, ensuring it is up-to-date for correspondence.

- Navigate to the IFTA user section and check each box for the type of fuel used during the quarter. Fill in the total miles traveled and total gallons used according to Schedule 1 data.

- Calculate the average miles per gallon (MPG) by dividing total miles by total gallons. Ensure to round it to two decimal places.

- Complete the tax computation lines, including total tax due, penalties, and interest as applicable, following the instructions provided.

- Affirm your declaration under penalties of perjury by signing the form. Ensure that either the taxpayer or an authorized preparer signs, including their printed name and title.

- Review all entered information for accuracy, making necessary corrections.

- Once finalized, save your changes, and prepare the form for faxing, ensuring all necessary attachments are included as per the guidelines.

Start filling out your Nevada Ifta Tax Return By Fax Form online today to ensure compliance and timely submission.

Related links form

How to Calculate IFTA Tax: Fuel Tax Reporting Total Miles Driven in Each State/Province X ÷ Overall Fuel Mileage = Fuel Consumed in Each State/Province X. Fuel Tax Required in Each State/Province X – Fuel Tax Paid in Each State/Province X = Fuel Tax Still Owed to Each State/Province. Extra Tips for IFTA Fuel Tax Reporting.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.