Loading

Get Foreign National Tax Setup Change Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Foreign National Tax Setup Change Form online

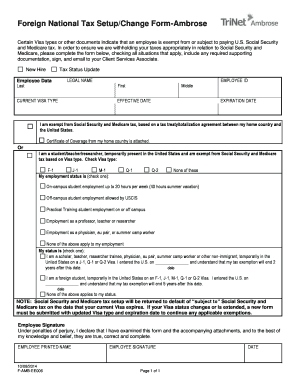

Filling out the Foreign National Tax Setup Change Form online is an essential step for foreign workers in the United States to ensure the correct withholding of Social Security and Medicare taxes. This guide will provide you with clear and concise instructions to help you navigate through each section of the form.

Follow the steps to accurately complete the form online:

- Click ‘Get Form’ button to obtain the form and open it in your preferred online platform.

- Fill in your legal name in the specified fields. Ensure that your last, first, and middle names are entered correctly.

- Indicate your current visa type by selecting the appropriate option from the list provided.

- Complete the effective date and expiration date fields. These dates are crucial for determining your tax status.

- If applicable, indicate your exemption from Social Security and Medicare tax based on a tax treaty or totalization agreement by checking the appropriate box and attaching any required Certificate of Coverage.

- If you are a student, teacher, or researcher, check the relevant visa type and employment status, choosing the one that best describes your current situation.

- Input the date you entered the United States in the specified field, acknowledging that your tax exemption will expire after a defined period.

- Sign the form at the designated section and print your name below it. Ensure that the date of your signature is also provided.

- After filling out all sections, review the form for accuracy to ensure all information is complete.

- Save your changes, then download, print, or share the completed form as needed.

Complete your Foreign National Tax Setup Change Form online today for accurate tax withholding.

Form W8, W 8BEN, or W8 form is used by non-resident aliens who do work and/or make income in the U.S. or by foreign business entities who make income in the U.S. If you're a legal citizen of the United States, at no point will you have to worry about filling out the form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.