Loading

Get 2001 Ftb Pub 1067 Guidelines For Filing A Group Form 540nr 10-99-1067 - Ftb Ca

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2001 FTB Pub 1067 Guidelines For Filing A Group Form 540NR online

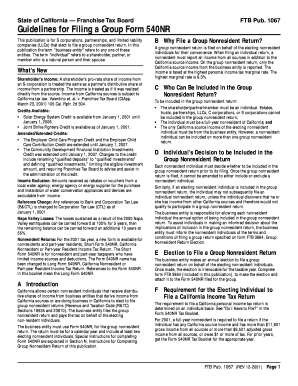

This comprehensive guide provides clear instructions on how to complete the 2001 FTB Pub 1067 guidelines for filing a group Form 540NR online. By following these steps, users can efficiently manage their group nonresident tax return.

Follow the steps to successfully complete the group Form 540NR.

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter the business entity’s information, including the name and address, at the top of the Form 540NR.

- Attach Schedule 1067A, Nonresident Group Return Schedule, to the Form 540NR to report individual incomes.

- Complete Step 1, Step 1a, and Step 2 as outlined in the instructions, ensuring you skip lines as detailed.

- Calculate and enter total distributive shares of California source income, total California tax, and any applicable credits as per Schedule 1067A.

- If a payment is due, make it payable to 'Franchise Tax Board' and include necessary identifying information.

- Complete and sign Form FTB 3864 to confirm your election to file a group return, ensuring it has the appropriate authorization.

- Finally, review all entered information, save your changes, and choose to download, print, or share the completed form.

Start filling out your 2001 FTB Pub 1067 Form 540NR online today!

You will need to file a California Nonresident or Part-Year Resident Income Tax Return (Form 540NR) , to report the California sourced portion of your compensation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.