Loading

Get Loan Application Form - Futuresaccocom

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Loan Application Form - Futuresaccocom online

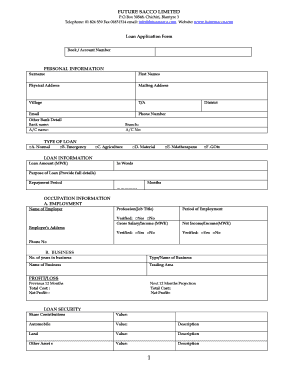

Completing the Loan Application Form is a crucial step in securing financial assistance. This guide provides clear and supportive instructions for users as they navigate through the online form, ensuring a smooth application process.

Follow the steps to successfully complete your loan application online.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Provide your personal information accurately. Fill in your surname, first names, physical address, mailing address, village, town/area (T/A), email, and phone number.

- In the other bank detail section, include the bank name, account name, district, branch, and account number if applicable.

- Select the type of loan you are applying for by ticking the appropriate box. Options include normal, emergency, agriculture, material, Ndatherapano, and GOtv.

- Specify the loan amount you are requesting in both numerical value (MWK) and in words. Clearly state the purpose of the loan providing full details.

- Indicate the repayment period in months that you anticipate will be necessary to repay the loan.

- Fill out the employment section with the name of your employer, your profession or job title, period of employment, gross salary or income, and net income. Ensure to verify the provided information.

- If self-employed, provide the business section with details including the number of years in business, type/name of business, and trading area.

- Complete the profit/loss information for the previous and next 12 months including total costs and net profit.

- List your loan securities, including share contributions, automobiles, land, and other assets, providing their respective values and descriptions.

- Carefully read and understand the authority to recover loan section, then sign to authorize the terms outlined.

- Provide the required signatures for the borrower, witness, and next of kin along with their respective contact information.

- Once completed, review all supplied information for accuracy, then proceed to save changes, and download or print the application.

Begin your application process by filling out the Loan Application Form online today.

Mortgage Approval in Principle (AIP) is valid for 6 months.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.