Get Au Nat72710b 2008-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AU NAT72710B online

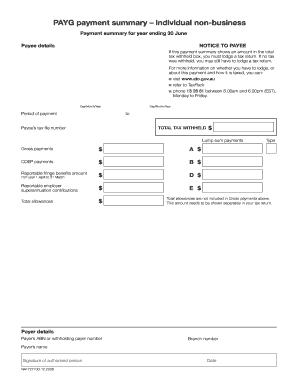

The AU NAT72710B form is essential for individuals who receive payments and need to report tax information to the Australian Taxation Office. This guide provides a step-by-step approach to efficiently fill out the form online, ensuring clarity and accuracy in your submission.

Follow the steps to complete your AU NAT72710B payment summary accurately.

- Click the ‘Get Form’ button to obtain the form and open it in the editor for online use.

- Enter your payee details in the designated fields. This includes providing your tax file number and ensuring that your personal information is accurate.

- Specify the period of payment by filling in the respective dates in the format Day/Month/Year.

- In the 'Total tax withheld' box, enter the total amount of tax that was withheld from your payments.

- If applicable, fill in the lump sum payments, gross payments, and any CDEP payments in their respective fields, ensuring accuracy in the figures.

- Report any fringe benefits in the section for the reportable fringe benefits amount, indicating the FBT year running from 1 April to 31 March.

- Include reportable employer superannuation contributions in the designated box if relevant.

- Record the total allowances in the appropriate box, noting that this amount should be reported separately in your tax return.

- Complete the payer details section by providing the payer’s ABN or withholding payer number, along with the payer’s name and signature of the authorized person.

- Review all entries for accuracy and completeness before proceeding to save changes, download, print, or share the form as needed.

Start completing your AU NAT72710B payment summary online today for smooth and accurate tax reporting.

To complete a debit authorization form, begin by providing your banking details, including your account number and routing number. Clearly state the amount and frequency of the debit transactions and ensure that it aligns with any agreements you have made. For guidance related to specific forms like AU NAT72710B, consult resources or platforms that specialize in tax forms and compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.