Loading

Get Fatca Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FATCA form online

Filling out the FATCA form is an essential step for account holders to ensure compliance with tax regulations. This guide will walk you through each section of the form, providing clear and helpful instructions to assist you in completing it accurately.

Follow the steps to complete the FATCA form online

- Click ‘Get Form’ button to obtain the FATCA form and open it for completion.

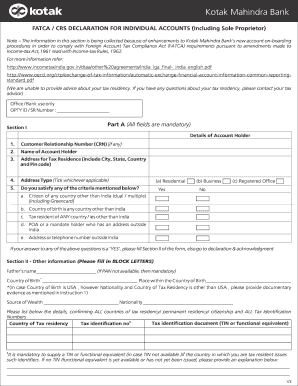

- Begin with Section I, Part A, where you will enter your mandatory details such as Customer Relationship Number, Name of Account Holder, and Address for Tax Residence (include City, State, Country, and Pin code).

- In the Address Type field, select the appropriate type by ticking the applicable box.

- Proceed to the criteria questions. Respond ‘Yes’ or ‘No’ to determine if you satisfy any of the listed criteria, including citizenship or residency in countries other than India.

- If you answered ‘Yes’ to any criteria, complete Section II. In BLOCK LETTERS, fill out your Father's Name (if PAN is not available), Country of Birth, and Place within the Country of Birth.

- List your Source of Wealth and Nationality. Confirm all countries of tax residency, permanent residency, or citizenship, along with Tax Identification Numbers (TINs) for each country.

- If a TIN is not available, provide an explanation as required.

- Review the declaration and acknowledgment section, and provide your signature and date to affirm that all information is accurate.

- Once all sections are filled, save your changes, and you have the option to download, print, or share the completed form.

Complete your FATCA form online to ensure compliance with tax regulations.

Directly hold foreign currency: If you have foreign currency that isn't held in a financial account, then it isn't reportable under the terms of FATCA. This means that you are in personal possession of the foreign currency…so whatever you keep in your wallet, your safe, or under your mattress.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.