Loading

Get Gratuities And Commissions Fees And Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Gratuities And Commissions Fees And Tax online

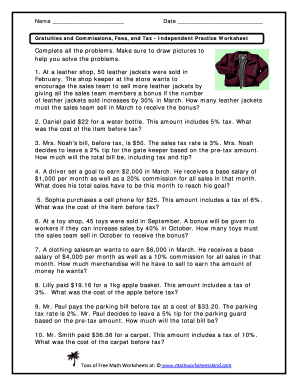

This guide provides a step-by-step approach to filling out the Gratuities And Commissions Fees And Tax form online. It will help you navigate through each section and field of the form easily, ensuring you complete it accurately.

Follow the steps to complete the Gratuities And Commissions Fees And Tax form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name in the designated field at the top of the form.

- Next, enter the date in the specified format, ensuring clarity and accuracy.

- Proceed to the main section where you will work on calculating gratuities and commissions based on the examples provided.

- For each problem, read the scenario carefully and draw pictures if needed to help visualize the calculations.

- Complete the calculations for each item listed, ensuring to show your work and confirm your answers.

- Once all problems are completed, review your calculations for accuracy.

- Finally, save your changes, and choose to download, print, or share the completed form as needed.

Start completing your Gratuities And Commissions Fees And Tax form online today!

In general, bonuses and commissions are taxed the same way. The IRS classifies bonuses and commissions as supplemental wages and levies a flat 22% federal withholding rate for this pay.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.