Loading

Get Foreign Transfer Allowance Worksheet Dssr 240 - Cnic - Cnic Navy

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Foreign Transfer Allowance Worksheet DSSR 240 - CNIC - Cnic Navy online

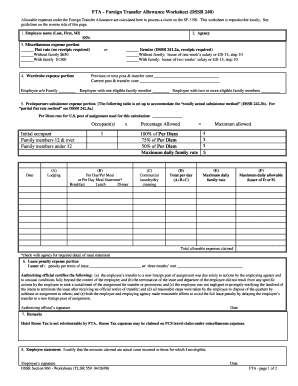

The Foreign Transfer Allowance Worksheet DSSR 240 is an important document for employees transferring to a foreign duty station. This guide will provide you with clear instructions on how to complete this worksheet accurately and efficiently online.

Follow the steps to successfully complete the Foreign Transfer Allowance Worksheet online.

- Press the ‘Get Form’ button to access the Foreign Transfer Allowance Worksheet. This will allow you to open the form in the online editor.

- Begin by filling in your employee name in the designated field (Last, First, Middle Initial). This is crucial for your identification.

- Next, enter your agency name and Social Security Number in the respective fields.

- For the miscellaneous expense portion, choose whether to claim a flat rate (no receipts required) or to itemize expenses. Enter the appropriate amounts: $650 for without family or $1300 for with family.

- Proceed to the wardrobe expense portion. Indicate if you are without family or if you wish to itemize. If itemizing, ensure you provide necessary receipts. Reference the limits based on your salary.

- In the predeparture subsistence expense section, enter the per diem rate for your U.S. post of assignment and fill in the table for lodging, meals, and total daily expenses. Be sure to calculate the maximum allowable amounts based on the applicable percentages.

- Complete the lease penalty expense portion by indicating the lesser of the lease penalty or three months' rent. Ensure your authorizing official certifies the conditions stated.

- In the remarks section, note that hotel room tax is not reimbursable by the Foreign Transfer Allowance. This detail can be relevant for your travel claim.

- Finally, sign and date the employee statement to certify that the claimed amounts are accurate and legitimate costs incurred.

- Once all fields are filled correctly, you may save your changes, download the form, print it, or share it as necessary.

Start completing your Foreign Transfer Allowance Worksheet online today!

Related links form

For those employees who qualify, the flat amounts (no itemization; no receipts required) for a two-zone transfer are: $700 for an employee without family; $1,150 for an employee with one family member; and $1,500 for an employee with two or more family members. For more information, see DSSR 242.2.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.