Loading

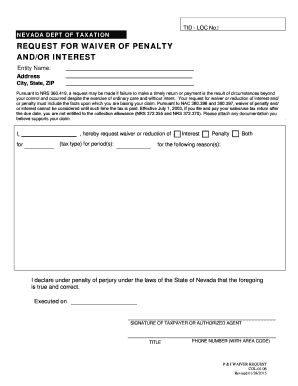

Get Nevada Request For Waiver Of Penalty Andor Interest Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nevada Request For Waiver Of Penalty Andor Interest Form online

Filling out the Nevada Request For Waiver Of Penalty Andor Interest Form is an important step for individuals and entities seeking relief from penalties or interest due to uncontrollable circumstances. This guide offers a clear, step-by-step approach to help users navigate the form efficiently and accurately.

Follow the steps to complete the waiver request form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the entity name in the designated field. Ensure that the name matches the tax records.

- Provide the complete address, including street address, city, state, and ZIP code, in the corresponding sections.

- In the area requesting the reason for the waiver, clearly state the circumstances that led to the failure in making a timely return or payment.

- Specify which type of tax is involved in the request by selecting tax type from the available options listed.

- Indicate the relevant period(s) to which the request applies. Ensure this aligns with the tax records for accuracy.

- Select whether you are requesting a waiver for interest, penalty, or both by checking the appropriate box.

- Affirm the truth of the submitted information by executing the declaration, which verifies the content under penalty of perjury.

- Sign the form in the designated area, including the title of the signer if the individual is an authorized agent.

- Finally, provide a phone number with the area code for any follow-up communication. Review the form for accuracy before submitting.

- Save changes, download, print, or share the completed form as needed after ensuring all information is correctly filled out.

Begin completing your Nevada Request For Waiver Of Penalty Andor Interest Form online today!

Failure to File or Pay Penalties Fires, natural disasters or civil disturbances. Inability to get records. Death, serious illness or unavoidable absence of the taxpayer or immediate family. System issues that delayed a timely electronic filing or payment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.